€500M additional revenue hidden in the Italian market

Omnitele estimates that there is over €500M incremental mobile revenue available in Italy, a potential that is hidden in the demand of the already established subscriber base. This growth opportunity does not require any sales or updated offering, only focused improvements in the data service quality of customers.

Hidden Revenue achievable with focused quality improvements

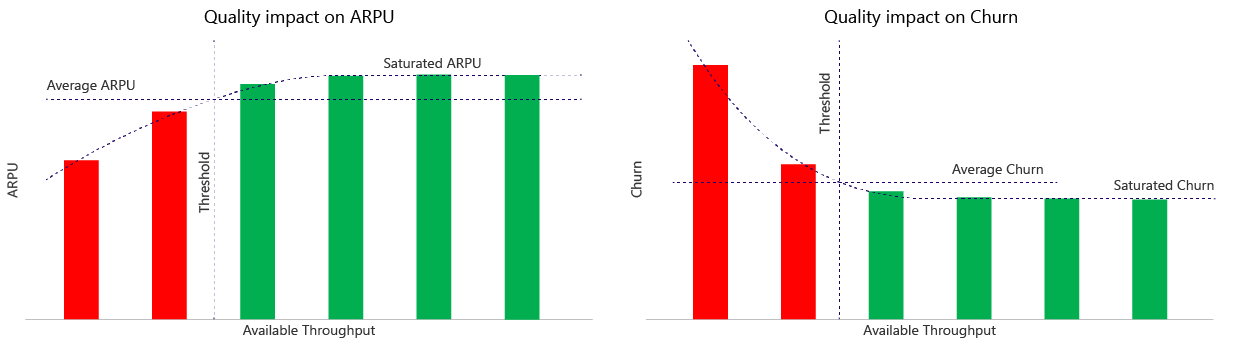

In all the markets studied by Omnitele the same dynamics prevail. Once the experienced data service quality of customers exceeds certain threshold levels, the average ARPU and churn of a customer segment settles into a saturated level. We call these levels Saturated ARPU and Saturated Churn. At saturated levels the monetised data usage and churn are not anymore significantly impacted by the experienced data service quality.

The quality driven revenue growth potential comes from the customers who experience quality below the market and segment specific threshold quality levels. By proactively improving these customers’ data service quality, we can increase their ARPU and decrease their risk of churning. We call this additional revenue potential Hidden Revenue. When we identify the quality threshold levels, we can focus the improvement actions to the specific locations where the most Hidden Revenue can be regained.

Omnitele analysis provides a high-level estimate of the Hidden Revenue in the Italian market, by using generic customer behaviour prediction models, developed by Omnitele, and by adjusting those to the Italian market.(1) The data service quality assessment in this analysis is based on crowdsourced customer data, collected by thousands of Italian subscribers by using a measurement application provided by 4GMARK. (1) To reveal the Hidden Revenue in the three different Italian networks, the adjusted Omnitele models are applied on top of the operator specific customer quality distributions. The analysis can be reproduced in any market, and further focused into specific areas of interest.

Wind Tre with the most Hidden Revenue

According to the Omnitele analysis Wind Tre has an estimated €315M of Hidden Revenue to gain with focused quality improvements. The corresponding figure is €97M for Vodafone and €153M for TIM. The Hidden Revenue represents roughly 7% of the Wind Tre mobile revenue, and 3% of Vodafone and 4% of TIM respectively. The revenue potential estimate is calculated by utilising public market data on Italy (2) and public operator financial figures from 2016-2017. (3,4,5,6)

[visualizer id=”45455″]

Dividing the results into prepaid and postpaid reveals how dominant the prepaid subscribers are for the Hidden Revenue in Italy. An estimated 86% of the subscribers use prepaid plans in Italy.(2) According to the Omnitele analysis the prepaid alone stands for 96% of the total Hidden Revenue in Italy. Hence, the data service quality driven growth potential is primarily coming from the increase in capitalised data usage of the prepaid subscribers. The Omnitele analysis estimates that the average prepaid ARPU can be increased by up to €1, purely with focused improvements on the data service quality.

Postpaid subscriber Hidden Revenue comes primarily from mitigation of their churn risk. With the analysed 2017 data, the influence of the data service quality on churn seems somewhat limited in Italy. According to the Omnitele analysis, less than 10% of total postpaid churn in Italy is estimated to be caused by low data service quality. In other words, more than 90% of the postpaid churn is caused by other reasons than the data service quality. This moderate impact of data service quality on churn comes mainly from the relatively low variations in the quality between different customer segments.

[visualizer id=”45456″]

Data throughput behind the Hidden Revenue

This analysis relies on data service quality measurements, collected from the 4GMARK network performance measurement database of over 12500 users across Italy (1). Furthermore, the analysis focuses on the Available User Throughput (Mbps) in the downlink. Omnitele studies have shown that Available User Throughput is the dominant data service KPI driving the customers behaviour, especially in developed markets where extensive mobile data service coverage has already been established. Available User Throughput is also a KPI that can be directly controlled by the operator’s optimisation actions and capacity expansions.

Overall, Vodafone and TIM are well positioned with the average Available User Throughput, also by international benchmark. However, the average figures do not tell the whole story as the quality varies notably between customers, and it’s the customers with the lowest quality that accumulate most of the Hidden Revenue. Therefore, for example the amount of users with less than 5Mbps of Available User Throughput is more important metric from Hidden Revenue perspective than the averages.

[visualizer id=”45332″]

[visualizer id=”45327″]

The main reasons behind low Available User Throughput can be identified with more detailed analysis on the 4GMARK data. The reasons can for example be LTE coverage limitations, or capacity congestion. The detailed analysis will also reveal how much Hidden Revenue could be regained with different actions, such as expansion of the LTE coverage. Further analysis on the network originating data (OSS, BI) can also more precisely pinpoint the sites with the most Hidden Revenue, what are the local root causes holding it, and what are the most cost-efficient solutions to retain the Hidden Revenue. It is important to note, that the critical quality gaps are typically concentrated in specific locations and customer groups, and thus the relative Hidden Revenue can locally be very high and hence also fairly cost-efficient to reach.

This analysis is based on the Italian market status and data for 2017. For 2018 and beyond, the quality expectations keep evolving as new and more demanding services emerge, and the overall data traffic continues to grow and further stretch the network capabilities. This means that the significance of the Hidden Revenue continues increase. This calls for predictive and customer value driven network quality management.

(1) 4GMARK mobile network performance measurement database from Italy 2017, with total 12500 users and 76300 speedtest measurement samples

(2) AGCOM, Communication Markets Monitoring System, 3/2017

(3) Wind Tre, EBITDA* up by 2.9%, solid results in achieving synergies, 9/2017

(4) Vodafone Group Plc, Results For the quarter ended 30 June 2017, 7/2017

(5) Vodafone Group Plc, Annual Report 2017, 2017

(6) TIM Group, Interim Report on Operations to 31 March 2017 approved by Board of Directors, 3/2017

Interested in further analysis?

Are you interested in a more detailed analysis of the Italian market, or a tailored analysis of another market?

The analysis can included for example:

- Prepaid & postpaid data demand, data quality driven churn, and total Hidden Revenue

- Service experience, customer satisfaction, NPS

- Result drill-in to different areas and customer segments

- Critical threshold and saturation levels for quality KPIs

- Roots causes behind the quality gaps and Hidden Revenue

- Optimal improvement actions to maximise impact on the targets and to maximise ROI

- Full network measurement database with all technical KPIs per test device (4GMARK)

Please contact us below with your preference.